ICC agrees to rates postponement policy for COVID-19 related hardships

Lucy Henry

30 April 2020, 2:26 AM

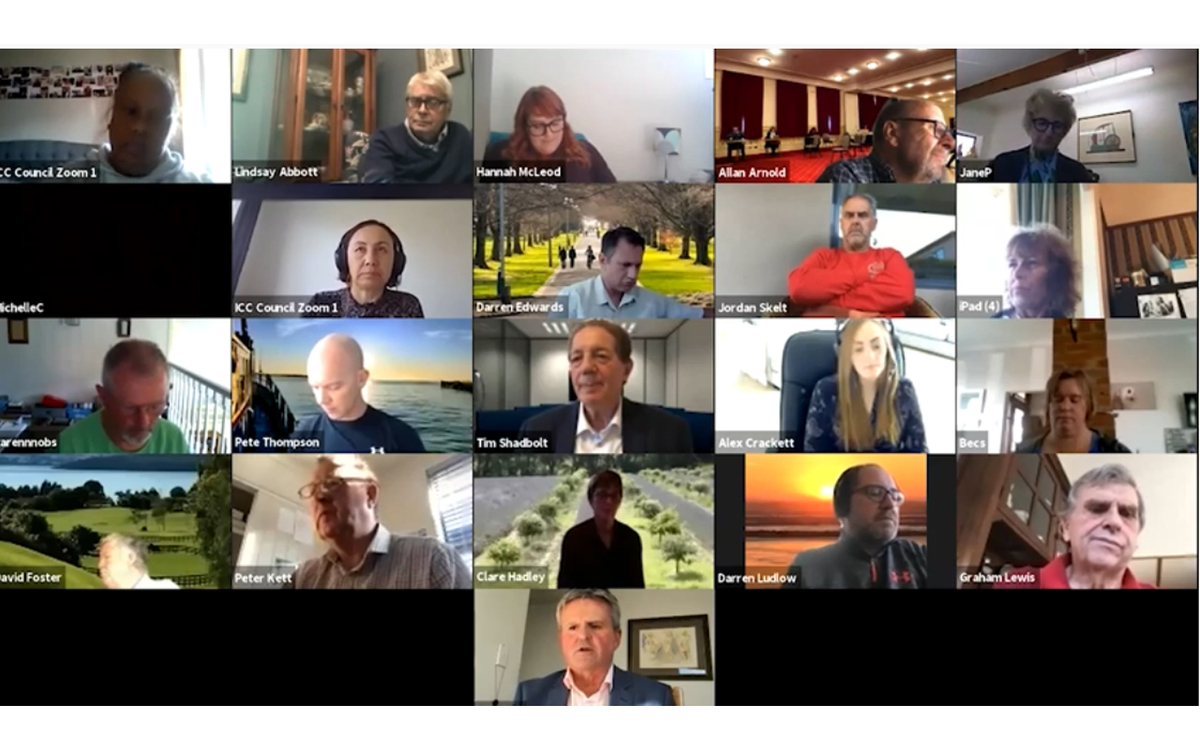

The Invercargill City Council's Committee of Council meeting was held on Tuesday via video conference.

The Invercargill City Council's Committee of Council meeting was held on Tuesday via video conference.The Invercargill City Council has agreed to a draft rates postponement and remission policy but rates could still increase this coming year by 2%.

At a Committee of Council meeting held on Tuesday via online conferencing, councillors agreed to a draft rates postponement and remission policy report, which will enable those who are affected by COVID-19 to postpone their rates for a period of one year.

To be eligible to apply for a rates postponement, ratepayers must be able to prove that they have suffered at least a 20% loss of income.

Interim Group Manager of Finance Services Dave Foster said a 3.5% interest rates would apply to those who applied for the rates postponement, to stop those who don't need it trying to get "a free lunch".

"We've gone at 3.5% interest because there's no application fee for it, the interest rate that's set is just slightly above our cost of funds, but also below the lowest cost of funds for a ratepayer."

He said it was a flexible option that was there to provide support but would deter people from taking advantage, mentioning the government's recent wage subsidy where he said it "seems" some people have exploited the scheme.

There was also some discussion around the potential for a 2% rates increase.

Cr Toni Biddle first addressed any misunderstandings that the council was deciding on rates at this meeting.

"There has been a bit of misunderstanding that we were going to strike the rates today, but that is not the fact. Today is about the rates postponement and remissions policy."

She said the council must go through the correct processes and "adopt the annual plan" first.

Cr Nobby Clarke asked why the council hadn't made a decision yet on what the exact rates increase would be, as the community need clarity at the time.

"I find it a little bit hard to fathom that places like SDC [Southland District Council] has already announced last week what their rates were going to be."

"I think members of the community are wanting a bit of a steer on this, about what their rates are going to be," he said.

He did, however, agree with Mr Foster that a 2% rates increase was a sensible option.

Cr Clark said he had changed his mind after Mr Foster had explained in-depth to him, the reasons behind this move at a council workshop earlier in the month.

"You all know I've been an advocate for zero rates increase for a long time, but based on the advice he [Mr Foster] gave me, which was quite a large overview of what we're facing here in New Zealand... I thought his suggestion at 2% was a good point and is a good benchmark to go to".

"Why don't we just give them [the public] an indication of what we're looking towards because it's unlikely to change?"

Cr Ian Pottinger suggested that the council could change the criteria to be eligible for the rates postponement scheme to a more generic term such as "financial hardship" so it didn't risk leaving any people in need out.

Cr Allan Arnold said keeping the criteria at households needing to prove they had suffered a 20% loss of income was a good option as it was easy to prove.

"Usually financial hardship is from a loss of income. It's important to have simple criteria... keep it simple, keep it clean, keep it neat," he said.

Crs Darren Ludlow and Alex Crackett agreed, saying the term "financial hardship " was too subjective and might leave it open to some people taking advantage of it.

Further discussions around potential rates rise will continue at the next Committee of Council meeting next Tuesday at 3pm.

The public is also encouraged to contact the ICC directly if they are concerned about being able to pay their rates.

AG | TRADES & SUPPLIES